Offices to Let Market in Manchester: 2023 Analysis and 2024 Predictions

High quality commercial workspace with professional secretarial services.

2023 Analysis. The Manchester office market experienced a mixed year in 2023.

With strong demand for Grade A space but a softening of rents in some sub-markets. The overall vacancy rate fell to 7.8%, its lowest level since 2007, while take-up reached 2.8 million sq ft, the highest since 2018.

Key factors influencing the market

Rising employee expectations: Employees are increasingly demanding more flexible and attractive workspaces, which is driving demand for premium office space.

Tech sector growth: Manchester’s tech sector is booming, attracting new businesses and expanding existing ones. This is putting upward pressure on demand for office space, particularly in areas with strong tech clusters.

Increased hybrid working: The pandemic has led to a shift towards hybrid working, where employees split their time between the office and home. This is reducing demand for large, centralised offices and increasing demand for smaller, more flexible spaces

Tech sector growth: Manchester’s tech sector is booming, attracting new businesses and expanding existing ones. This is putting upward pressure on demand for office space, particularly in areas with strong tech clusters.

Increased hybrid working: The pandemic has led to a shift towards hybrid working, where employees split their time between the office and home. This is reducing demand for large, centralised offices and increasing demand for smaller, more flexible spaces

Rents

- Grade A: Rents for Grade A space remained stable in 2023, with an average asking rent of £27.50 per sq ft. However, there was some softening in rents for smaller spaces in the city centre.

- Grade B: Rents for Grade B space fell by an average of 2.5% in 2023, driven by an increase in supply and softening demand. The average asking rent for Grade B space was £18.50 per sq ft.

Take-up

- Total take-up: Total take-up reached 2.8 million sq ft in 2023, the highest since 2018. This was driven by strong demand from tech companies, financial services firms, and professional services providers.

- Sub-market take-up: The strongest sub-markets for take-up in 2023 were the Northern Quarter and Ancoats, with both areas benefiting from their strong tech clusters.

2024 predictions. The Manchester office market is expected to remain stable in 2024, with continued demand for premium office space and some softening of rents in secondary sub-markets.

The following factors are expected to influence the market:

The continued growth of the tech sector:

The tech sector is expected to remain a key driver of demand for office space in Manchester. This is likely to lead to further development of tech hubs and an increase in demand for Grade A space.

The tech sector is expected to remain a key driver of demand for office space in Manchester. This is likely to lead to further development of tech hubs and an increase in demand for Grade A space.

The impact of hybrid working:

Hybrid working is likely to continue to have an impact on office space requirements, with some companies downsizing their office space and others looking for more flexible layouts.

Hybrid working is likely to continue to have an impact on office space requirements, with some companies downsizing their office space and others looking for more flexible layouts.

The wider economic outlook:

The wider economic outlook will also play a role in determining the performance of the Manchester office market. A strong economy is likely to support continued demand for office space, while a weak economy could lead to increased vacancy rates and falling rents.

The wider economic outlook will also play a role in determining the performance of the Manchester office market. A strong economy is likely to support continued demand for office space, while a weak economy could lead to increased vacancy rates and falling rents.

In conclusion…

Overall, the Manchester office market is expected to remain resilient in 2024. The city’s strong economic fundamentals, coupled with its growing tech sector and attractive workspaces, are likely to attract new businesses and drive continued demand for office space.

Our most recent posts

Beyond the Rent: Unmasking the Hidden Costs of Traditional Leases and How Serviced Offices Offer True Cost Savings

The landscape of business operations has seen remarkable shifts in recent years, largely driven by technological advancements and evolving work…

Read more

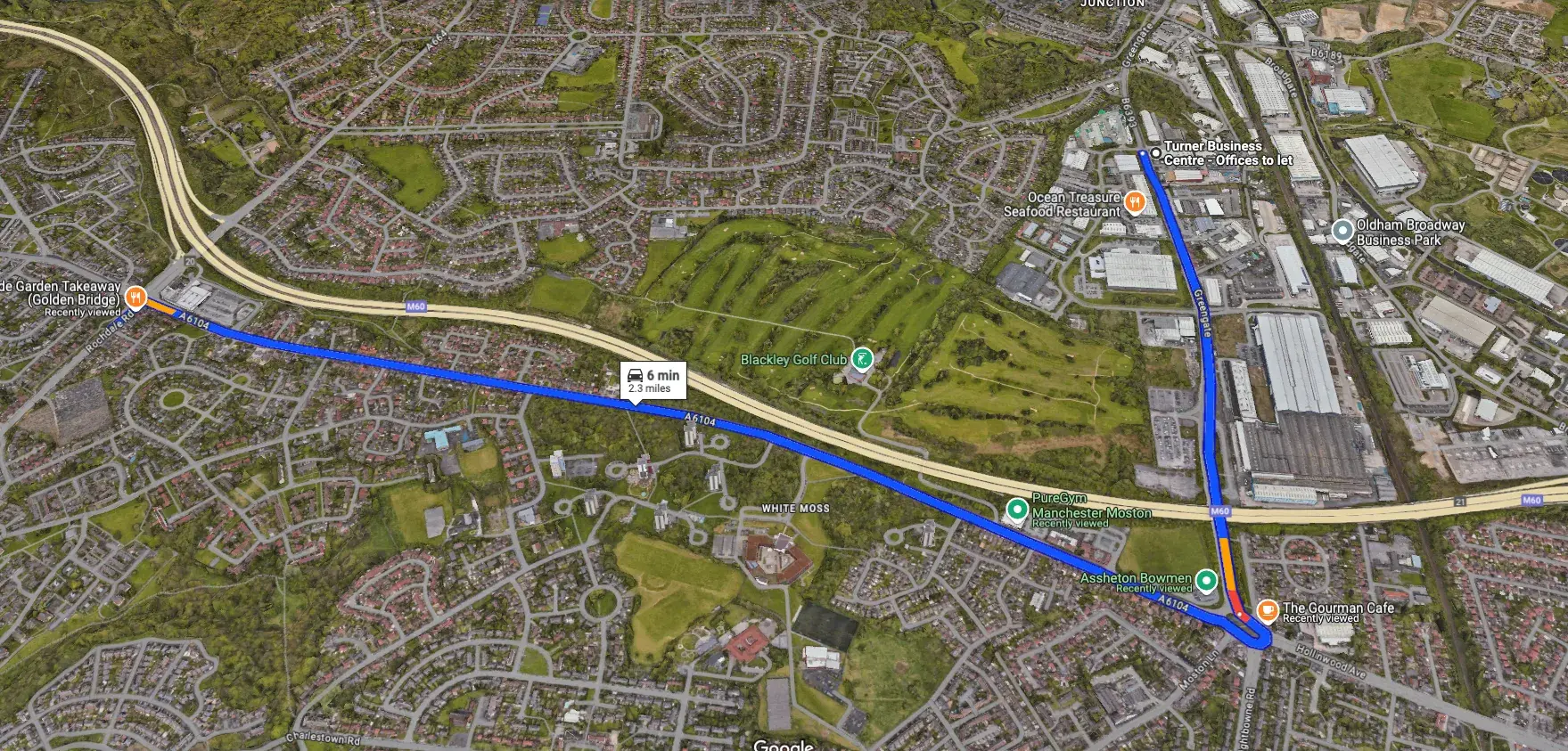

Looking for Serviced Offices in Blackley? Discover Turner Business Centre in Nearby Middleton

Are you searching for the perfect serviced office space in the Blackley area? Turner Business Centre, located just 2.3 miles…

2025 Office Boom: Manchester's Commercial Space Trends Revealed!

The landscape of business operations has seen remarkable shifts in recent years, largely driven by technological advancements and evolving work…

Read more